Market Commentary - July 2023

Summer has finally arrived! Given all that’s transpired over the year’s first half, we are providing a brief recap of key market events that have unfolded over the past three months.

Global Economic Landscape

The economy has remained resilient, a likely ripple effect of the trillions of dollars of fiscal stimulus injected into the economy from 2020 – 2021, combined with fiscal deficits that remain in the 6-7% range.

While manufacturing data continues to come in at recessionary levels, the service sector, which comprises over 75% of the economy, remains slightly in expansionary territory.

Demand for new residential construction remains steady, likely due to stagnant existing home sales as owners are hesitant to swap a 3% mortgage for a significantly higher rate.

Labor markets remain tight. Jobless claims, hours worked, and average payrolls are consistent with those typically seen in non-recessionary periods.

However, leading indicators continue to deteriorate (See Figure 1).

Figure 1 – Conference Board Leading Indicator (Blue Line)

Source: The Conference Board, *Bureau of Economic Analysis (BEA)

Financial Markets

As many larger market participants exited and reversed positions associated with a first-half recession, prior-year losers have become year-to-date market leaders. Gains have been led by the technology sector.

Index performance has been driven by the companies with the largest market capitalization. Merely five stocks have contributed over 80% of the market gains as of late June.

The United States market continues to outperform international regions of the world.

Debt Ceiling & Market Liquidity

Consistent with historical debt ceiling impasses, there was no shortage of the typical news headlines, but negotiations ended with a relatively uneventful agreement.

With Janet Yellen’s oversight, the U.S. Treasury will issue additional debt to replenish the General Account. The impact and magnitude of this liquidity drain depends on multiple factors. Still, it will be a net headwind for markets throughout the summer after a marked improvement in the liquidity function over the prior six months.

Earnings

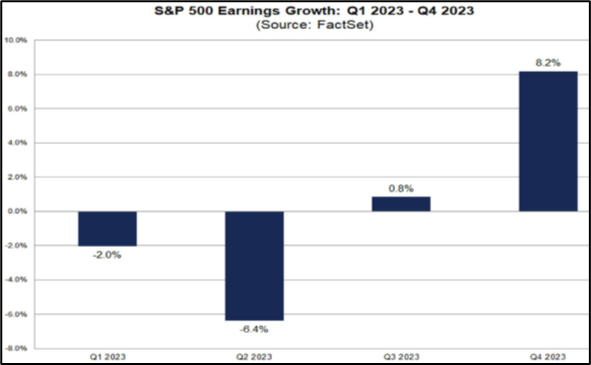

Aggregate earnings for S&P 500 companies declined by 2% for the first quarter. Analysts currently expect a continued decline for the second quarter, followed by a rebound in the second half (See Figure 2).

Figure 2 – S&P 500 Earnings Growth: Q1 2023 – Q4 2023

Source: FactSet

Federal Reserve

The Federal Reserve decided to “skip” an interest rate hike during its most recent June Federal Open Market Committee (FOMC) meeting, citing the need to digest further economic data over the coming weeks.

This decision was coupled with an increase in their expectations for future rate hikes, in which their assumptions imply an additional two rate hikes before year-end.

From a historical standpoint, resuming rate hikes after an initial pause is rare, so we will be watching the data closely. Inflation has declined over the past few months, although it will unlikely fall to their 2% target without a material deceleration in economic growth and the labor market.

We are excited to share that our new space will be completed by early fourth quarter, based on the current construction progress. We will share more updates about the project as we connect with you throughout the summer!

- Jason, Micah, Matt, Tim, & Victoria